I discussed housing in my prior blog, and how that’s good news for the economy. Single-family starts and permits have been surging recently, which is something you typically see when coming out of recessions. As opposed to something that happens prior to an economic slowdown. In fact, we look set to break an 8-quarter streak of residential investment being a drag on GDP growth. That’s a big deal when a sector that dragged GDP growth lower by 0.6 – 0.7% in 2022 flips to being a positive contributor.

However, in this blog, I want to talk about the other side of the housing market: multi-family housing.

Multi-family starts surged 28% in May and are now up 40% from a year ago.

Note: this segment is always very volatile, and we can assume there’ll be downward revisions. But that is still a significant jump and puts the current level of multi-family starts at the highest level since December 1985.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

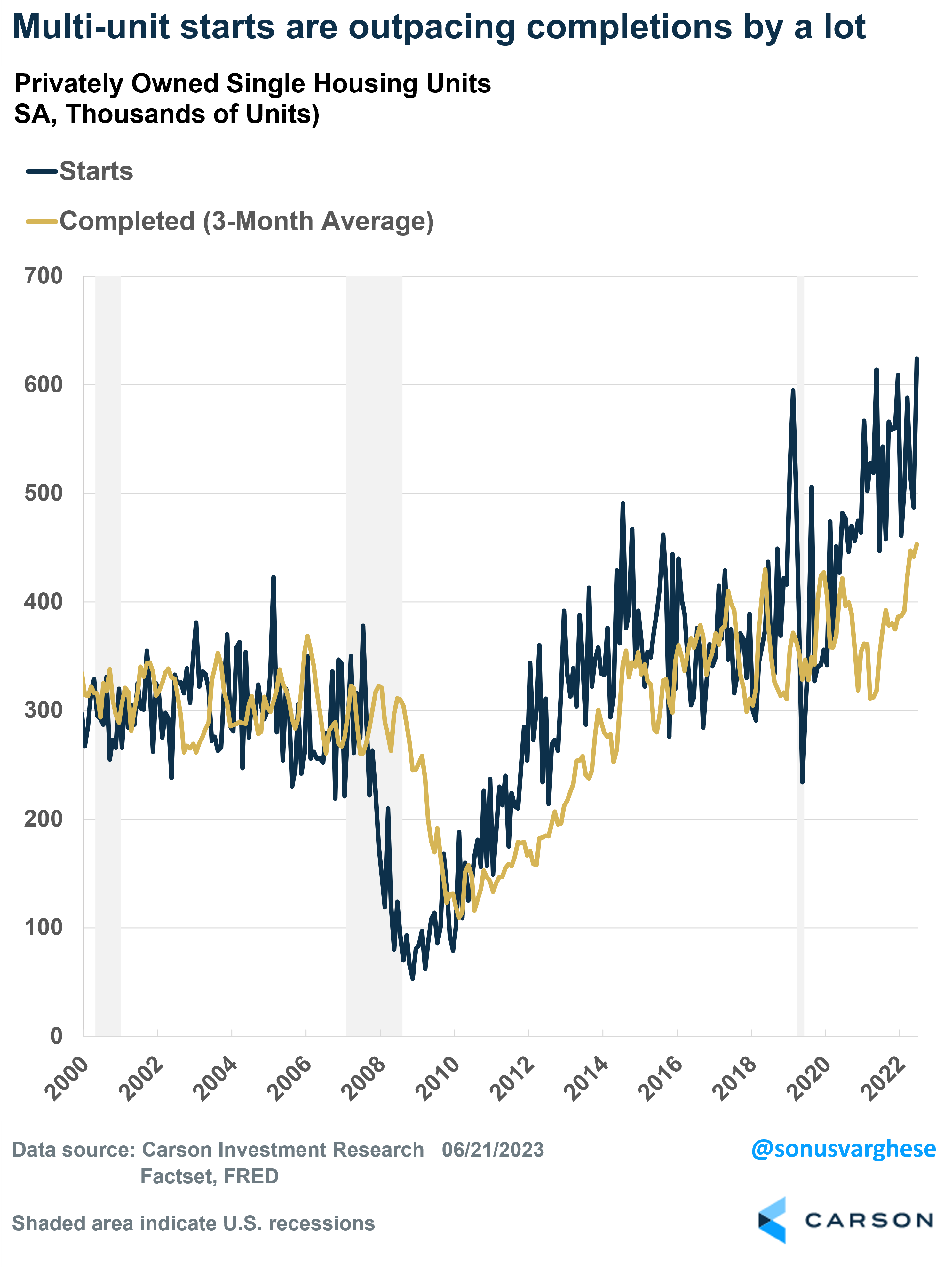

What’s interesting within the multi-family segment is that starts are outpacing completions by a wide margin. That is despite a 23% jump in completions in May.

The data tell us two things:

- Supply-chain issues are easing, which is leading to more completions. This was a major problem last year.

- Builders are positive about future demand for condos and rentals.

In short, there’s a lot more supply coming, as completions rise.

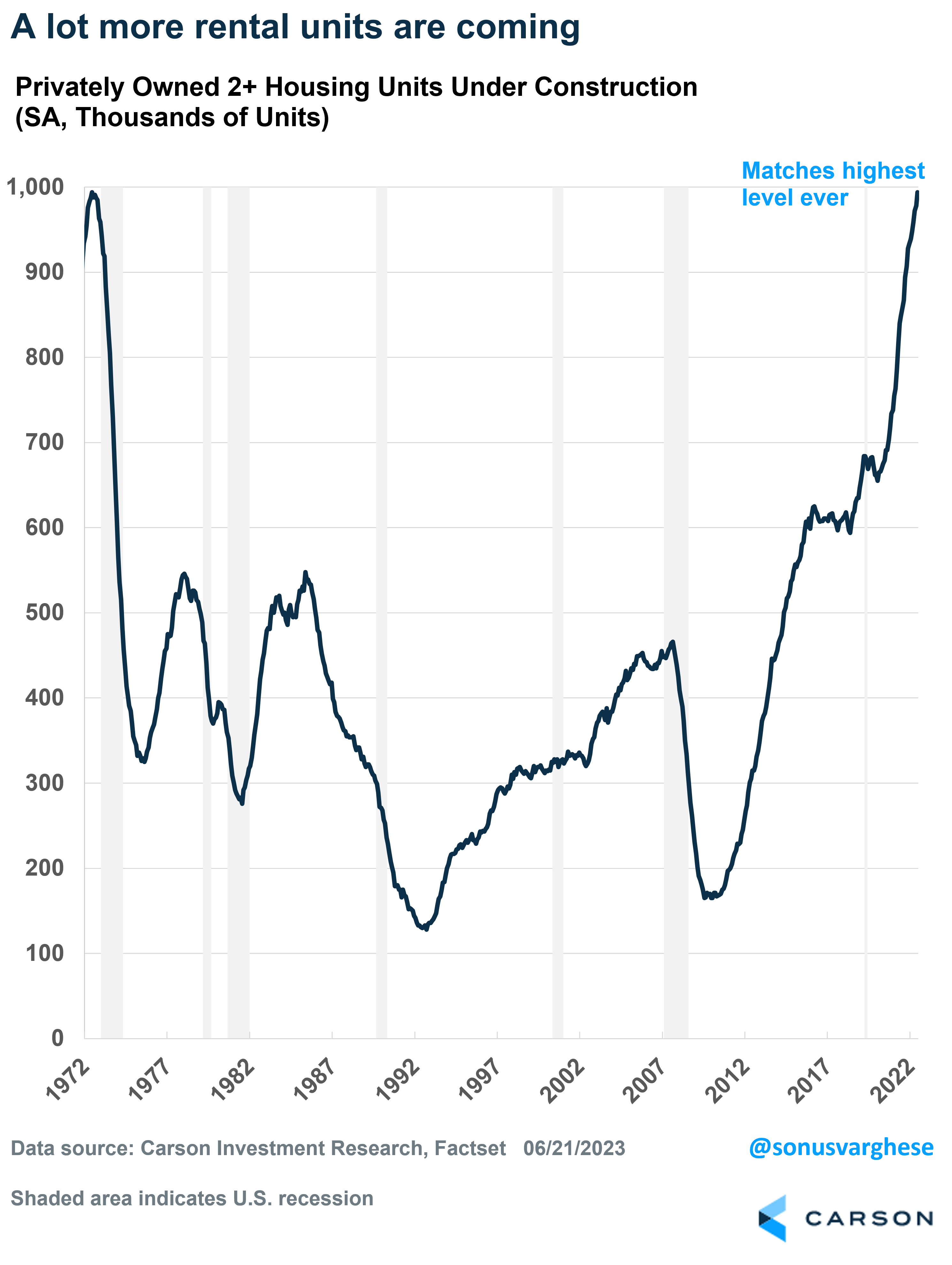

The supply picture becomes even starker when you look at the number of multi-family units under construction. These rose 1.6% in May and is up 17% over the past year. In fact, the total number of multi-family units under construction matches the all-time record set in May 1973.

The main reason for so many units remaining “under construction” is that supply-chain issues created construction bottlenecks. But that’s easing now, and completions are rising. Which means there are a lot of rental units coming on to the market right now, and there’s even more on the way.

More rental units = lower inflation pressure

As I discussed in piece last week, headline CPI inflation has fallen from a peak of 9.1% to 4% in May. Over the past 3 months, headline inflation is running at a 2.2% annualized pace. This has come on the back of lower energy, food, and vehicle prices.

At the same time, core inflation appears to have made no progress at all in recent months. Over the past 3 months, it’s running at a 5% annualized pace. The good news is that it’s down from a peak of more than 7%. Plus, it’s not accelerating. However, it’s been hovering in the 4 – 5% range since last November.

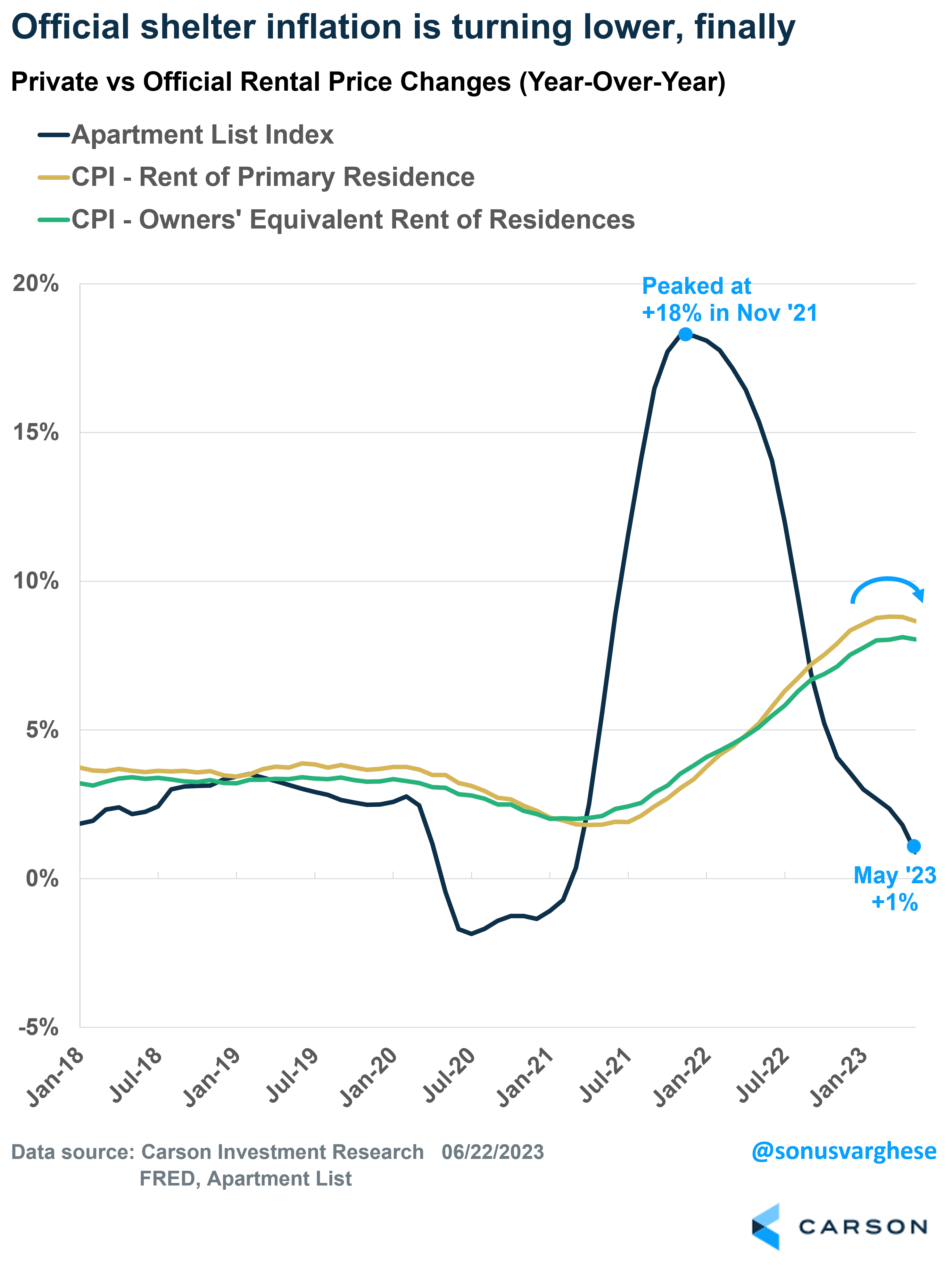

The problem is housing, or “shelter” inflation. Official shelter inflation is measured via rents, but the problem is that it lags actual market rents by 12-18 months. Private rents have decelerated sharply, slowing from a peak pace of 18% year-over-year to 1%. It’s taken a while, but the official data is finally turning around as well. It’s slowed from an annualized pace of 8-11% a few months ago to 5-6% in May. That’s still high, which is why core inflation remains elevated. But expect to see core inflation move lower over the next 6-8 months as official rental inflation decelerates even further.

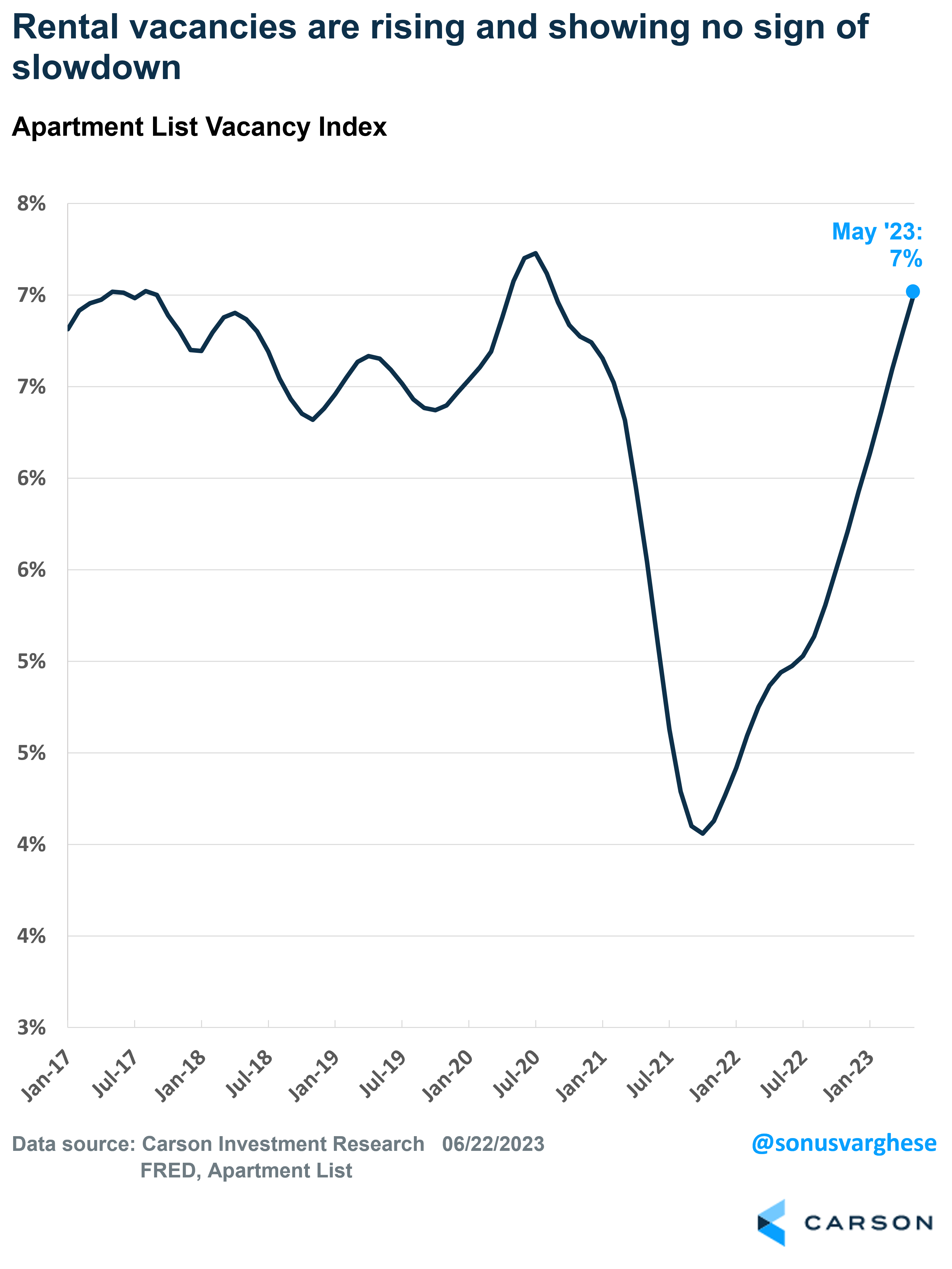

Another way to look at rent dynamics is to look at vacancies. Rental vacancies as measured by Apartment List, hit 7.2% in the summer of 2020 as more Americans moved in with family amid the pandemic. Vacancies subsequently plunged all the way to a low of 4.1% by October 2021 as a lot of renters were competing for fewer vacant units. This sent rents soaring in 2021.

We’re on the other side of that now, with vacancies rising over the past year. It’s started to accelerate recently, hitting 7% in May – which is higher than what we saw in 2018-2019. That’s because new supply is coming onto the market, easing rent inflation.

The latest housing data indicates that we’re likely to see further downward pressure on rent inflation well into 2024, as even more units come online.

That will alleviate significant pressure on the Federal Reserve, potentially leading to a sequence of interest rate cuts. Keeping rates at the current level as inflation falls means they’re implicitly making policy tighter. We believe it’s unlikely they want to do that, especially if there’s strong evidence that inflation is headed back to their target of 2%.

Think about how big a boost that will be for the economy (when it happens). This is why the multi-family housing activity data is such a big deal. Perhaps that’s why there are so many bullish indicators stacking on top of each other, as my colleague, Ryan Detrick, wrote recently.

Ryan and I talked about a lot of these things in our latest Facts vs Feelings podcast episode – take a listen.