“If Santa should fail to call, bears may come to Broad and Wall.”

—Yale Hirsh

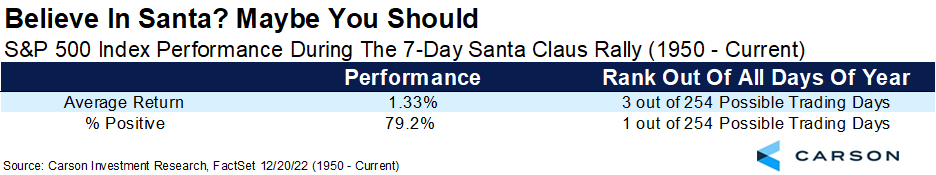

One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December but is actually only seven days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now by his son Jeff Hirsch), the real SCR is the final five trading days of the year and first two trading days of the following year, not just December. In other words, the official SCR is set to begin tomorrow, Friday, December 23, 2022.

Historically, it turns out these seven days indeed have been quite jolly, as no seven-day combo is more likely to be higher (up 79.2% of the time), and only two combos have a better average return for the S&P 500 than the 1.33% average return during the official Santa Claus Rally period.

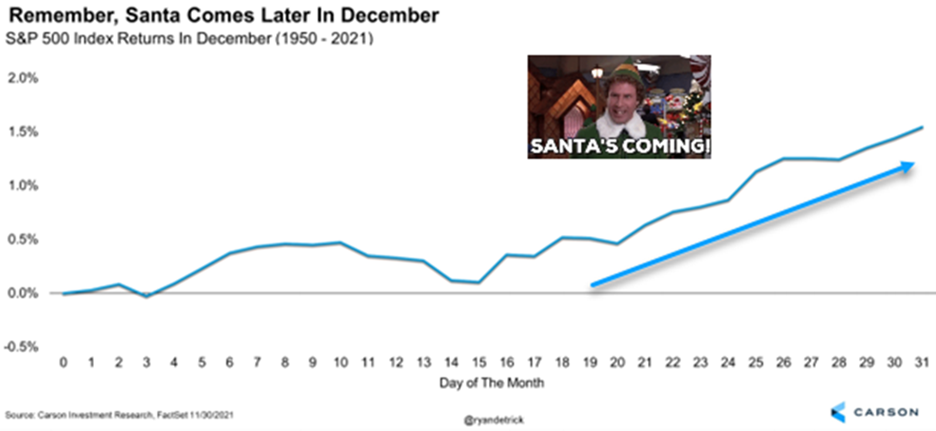

Here’s a chart we shared recently showing that it is the latter half of December when most of the seasonally strong gains occur.

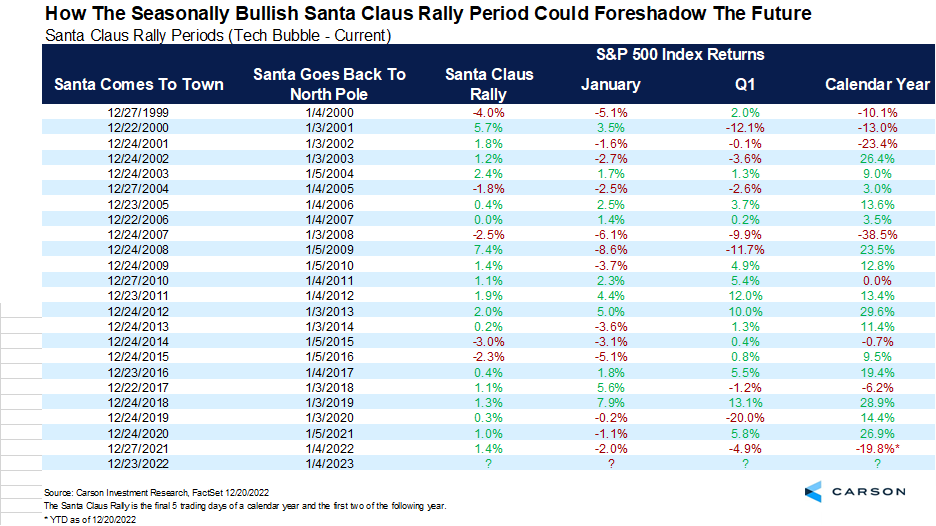

These seven days tend to be in the green, so that is expected. But fun trivia stat, the SCR has been higher the past six years and hasn’t been higher seven years in a row since the ‘70s. The all-time record was an incredible 10-year winning streak in the ‘50s and ‘60s. Here we show all the SCR periods since the tech bubble and how the S&P 500 does after each.

The bottom line is that what really matters to investors is when Santa doesn’t come, as Mr. Hirsch noted in the quote at the start of this blog.

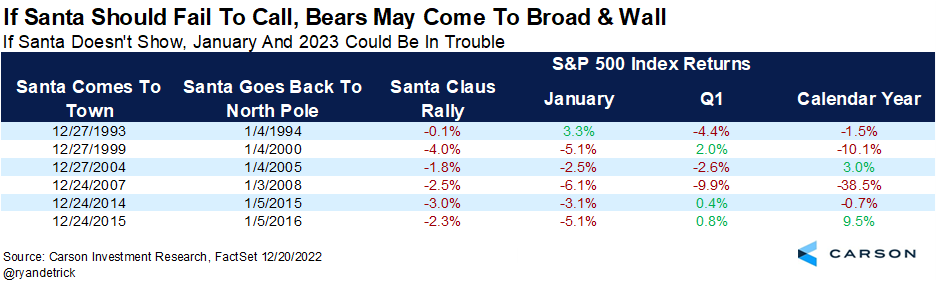

Here we show some recent times investors were given coal during these seven days, and the results after aren’t very good at all. The past five times that the SCR was negative saw January down as well. Then consider when there was no SCR in 2000 and 2008, not the best times for investors, and potentially some major warnings that something wasn’t right. Lastly, the full year was negative in 1994 and 2015 after no Santa. We like to say in the Carson Investment Research team that hope isn’t a strategy, but I’m hoping for some green during the SCR!

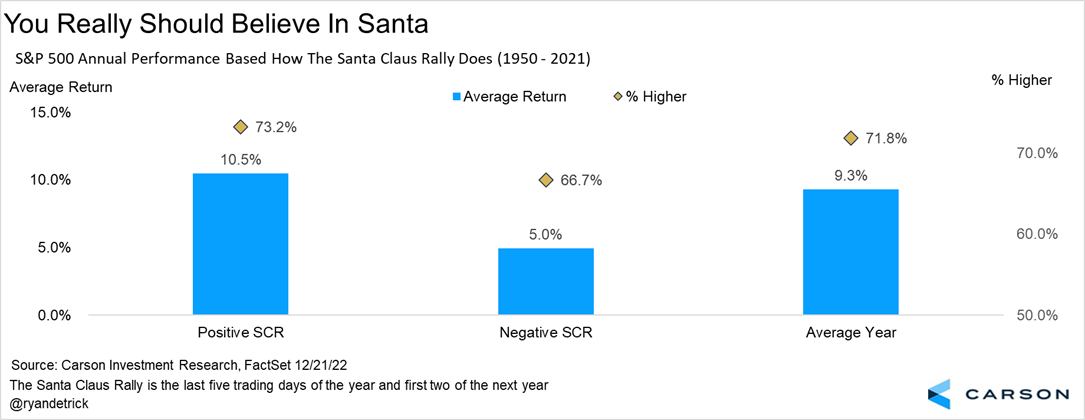

Finally, the average gains each year for the S&P 500 is 9.3% and is higher 71.8% of the time. But when there is a SCR, those numbers jump to 10.5% and 73.2%, falling to only 5.0% and 66.7% when there is no Santa. Sure, this is only one indicator, and we suggest following many more indicators to base your investment decisions, but this is clearly something we wouldn’t ignore either.

I was honored to join Mike Santoli on CNBC’s Overtime show this week to discuss this and more. You can watch the full interview below.